As financial institutions strive to become even more data-driven, the finance and risk domains are required to be in control of the flow of their data – from the source right up to the finance or risk product itself.

Being in control of the flow of data is not only critical from an internal point of view. External stakeholders also require financial institutions to evidence control of their data. Supervisory bodies increasingly expect improved data(sets) to perform their oversight, placing emphasis on the consistency and quality of data. Internal stakeholders are also dependent on data quality; finance & risk reporting and risk modelling require high-quality data to steer effectively and perform fact-based decision making.

Complicating this situation is that we typically face an IT and data landscape that is sub-optimal, due to siloed organisations, legacy systems and tactical solutions – all striving to meet regulatory requirements but needing significant manual adjustments and end-user computing to do so.

Unlock the value of data

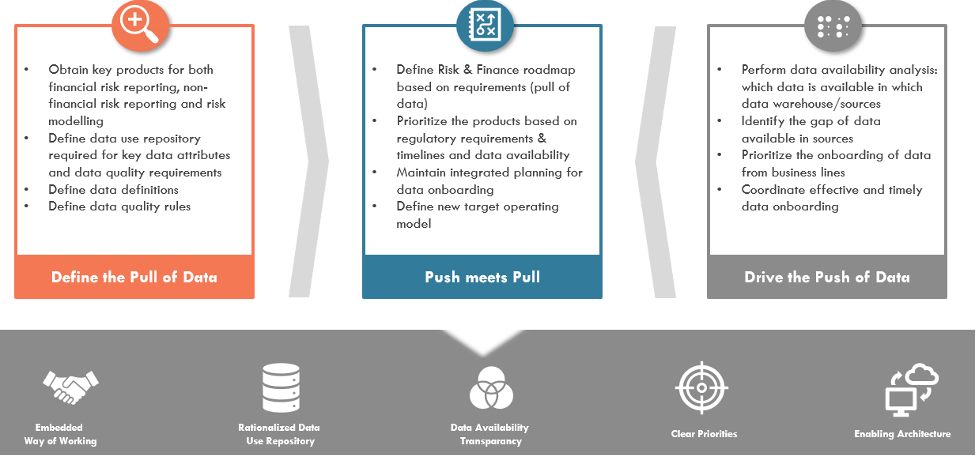

ACE can assist in standardising and streamlining your finance and risk data and process, by setting up a finance and risk data engine room. The data engine room orchestrates the push and pull of data and is comprised of three key elements:

- a standard way of working;

- a data management framework;

- a rationalised data use repository.

Orchestrating the Push and Pull of data

To unlock the value of data financial institutions need to transform to a data centric organization. An essential part of this entails that their Finance and Risk functions become more data driven by ensuring the availability of high-quality granular data.

By orchestrating the “push and pull” of data, Finance and Risk are able to be in control from the source right up to the risk models, regulatory & internal reports or datasets.

The importance of data

Being in control of data is not only critical from an internal point of view, external stakeholders also require financial institutions to evidence control, driven by requirements set in BCBS#239 and other regulations.

Supervisory bodies increasingly expect improved data(sets) to perform their oversight, placing emphasis on the consistency and quality of data. Internal stakeholders are also dependent on data quality; finance & risk reporting and risk modelling require high-quality data to steer effectively and perform fact-based decision making.

Complicating this situation is that we typically face an IT and data landscape that is sub-optimal, due to siloed organisations, legacy systems and tactical solutions – all striving to meet regulatory requirements but needing significant manual adjustments and end-user computing to do so.

Unlock the value of data

ACE can assist setting up a Finance and Risk data engine by standardising and streamlining your finance and risk data organisation. The data engine room orchestrates the push and pull of data and is comprised of three key elements:

- a standard way of working;

- a data management framework;

- a rationalised data use repository.

1. Regulatory pressure on Credit Risk Data Management and Data Quality is increasing

Data and Data Quality always have been one of the key topics within the Credit Risk domain since Basel II first explicitly mentioned the need for data retention and maintenance over a decade ago. In order to make sure financial institutions develop adequate data capabilities many regulations have since been created by various organisations (BCBS, ECB, EBA, local regulators) to create the blueprints for sound data management practices and sustainable architectural decisions. Also, Joint Supervisory Teams have over the years increased their scrutiny on Data Quality, and following insufficient results, on data management as a whole. Data Quality and data management have now become a substantial part of the supervisory demands.

2. Credit Risk Data Management remain complex for banks

Banks are struggling with Credit Risk Data Management due to legacy systems and sub-optimal cooperation between departments on definitions and use of data. As the data landscape is becoming more complex, agreements need to be made on who owns the definition of data and who owns the data, but also on how and when data is aggregated and reported. A coherent data governance framework, which should be included in the data management framework, is essential but difficult to implement as Credit Risk Data spans a good part of the banking organisation, ranging from commercial departments to risk department, capital management, reporting and IT.

3. Credit Risk Data Engine Room

To improve Credit Risk Management and get ahead of ever increasing regulatory and supervisory scrutiny, banks and Credit Risk Management in particular have to transform into data centric organisations where the value of data is recognized as a key asset across the organisation. By orchestrating the “push and pull” of data, Credit Risk Management is able to be in control from the source right up to the risk models, regulatory & internal reports or datasets.

3.1 Trusted Credit Risk information

A good Credit Risk Data Engine Room will improve the quality of data, enhance a common understanding of the meaning of data and create transparency of dataflows across the organisation. This will make the information more reliable and trustworthy, which will have several additional benefits:

- Credit Risk Management becomes more refined, allowing for improved credit pricing;

- Early warning indicators can be much stronger (and really early!);

- Portfolio management will become easier;

- Information can be fed back to clients which will increase their own awareness of potential credit risks;

- External (regulatory) and internal reporting become easier, requiring minimal or no more manual adjustments;

- Requests by supervisors (announced or ad-hoc, e.g. stress tests or during OSI) can be delivered faster, ideally without the usual number of Excels and e-mails.

3.2 Timely Credit Risk information

A Credit Risk Data Engine Room is connected to source systems, calculation engines and the reporting engine. It is supported by an integrated workflow to make sure the right governance and control remains in place. As a benefit, this will:

- Increase the speed on all processes related to Credit Risk Management, including Loan Origination and Credit Monitoring as the processes are standardised and optimised for direct use with minimal hand-over points;

- Contribute to a more accurate and near real-time monitoring of exposures or other key values;

- Provide assurance that the data/information is not only inherently reliable but also makes sense from a business perspective thanks to multiple stakeholders approving it in the workflow.

3.3 Improved Credit Risk models

Data requests for modelling are faster and the delivered data is of a high quality as the Credit Risk Data Engine Room facilitates fast sourcing of correct data (because of the use of aligned data definitions) upon the needs of the modeller. This results again in multiple benefits:

- Substantial cost savings as modellers can directly perform their calculations rather than search for data or improve and enrich data;

- More adequate modelling of risk parameters (PD, LGD and EAD) in order to estimate the accurate regulatory and economic capital;

- More consistency across models and across yearly revisions as there is more certainty the same data is used with the same understanding;

- Decreased model risk as results of the above benefits.

4. Unlock the value of Credit Risk Data

ACE can assist setting up a Credit Risk Data Engine by standardising and streamlining your Credit Risk Data organisation. The Credit Risk Data Engine Room orchestrates the push and pull of data and is comprised of three key elements:

- a standard way of working;

- a data management framework;

- a rationalised data use repository.